If the market begins to move in the opposite direction to which the large range candle has formed then all of the traders who have placed trades because of the large range candle will become trapped in losing trades, if the market continues to move against these traders at some point they will close their positions, thus putting orders into the market the bank traders will use to complete some kind of trading blogger.comted Reading Time: 12 mins Stop orders, also called stop loss orders, are a frequently used to limit downside risk. Stop orders help to validate the direction of the market before entering into a trade. It’s important to keep in mind, that stop orders are executed at the best available price after the market order is triggered, depending on available liquidity. Trailing Stop 30/11/ · I was told that Metatrader can't keep up and orders get stuck this way and there is no solution for it. Sometimes the only way to get rid of such "off quotes" orders is to contact MBT and have them remove it. It can also happen in a Live account when the order is actually executed in the market but Metatrader falls behind and think the order is

What You Need To Know About Trapped Traders - Forex Mentor Online

The most important information about future price direction cannot be found on a chart, orders stuck in market forex, instead its found by drawing conclusions as to what the candlesticks on your charts mean for other traders in the market. One of the things which cannot be seen, but is definitely occurring behind the scenes, is traders getting trapped in losing trades, orders stuck in market forex.

When a trader places a trade he expects the market to move in the direction he anticipates, orders stuck in market forex, if it fails to do so and the market begins moving in the opposite direction, depending on how much analysis he has conducted beforehand, he will still believe the market is going to move in the direction he anticipates.

Usually the trader has not put a stop-loss on his trade which means the thought of the market going against him has not even entered his mind, the only way for the orders stuck in market forex to close his trade now is if an event occurs which makes him believe the market has no chance of moving in the direction he anticipated.

Not all trapped traders will close their trades upon seeing the market make a sudden move against their positions. A large number of them will continue to hold as they believe the market could still come back to their entry point and they may be able to escape their losing trade with only a small loss. On some occasions the market will end up coming back to where the traders entered their trades and the traders are able to close their trade at a small loss or even better, at break-even.

The further away the market gets, the bigger the traders loss becomes. At some point the traders loss orders stuck in market forex become so big the trader has to close his trade, not necessarily because he wants to, but because has to as there is no more money left in his trading account. Finding out where traders are trapped in losing trades means having a small amount of knowledge on how retail traders in general enter into trading positions.

Overall there is one event in which you can be sure retail traders will place trades, orders stuck in market forex. This event is when the market makes a large move in one direction i. e a large range candle. If the market begins to move in the opposite direction to which the large range candle has formed then all of the traders who have placed trades because of the large range candle will become trapped in losing trades, if the market continues to orders stuck in market forex against these traders at some point they will close their positions, thus putting orders into the market the bank traders will use to complete some kind of trading action.

Virtually all traders will get trapped in the their trades due to them placing trades in the direction of a large range candle but in many cases large range candles often turn into a different type orders stuck in market forex candle before they close due to the banks entering the market. When pin bars are forming they will look heavily bullish or bearish depending on the type of pin, when the banks come in and either buy or sell again depending on the pin the candle which initially looked really bullish or really bearish now has a large wick on it.

The wick contains thousands of traders who are now trapped in losing trades because they believed the market was going to move in the opposite direction due to what the pin bar looked like when it was forming.

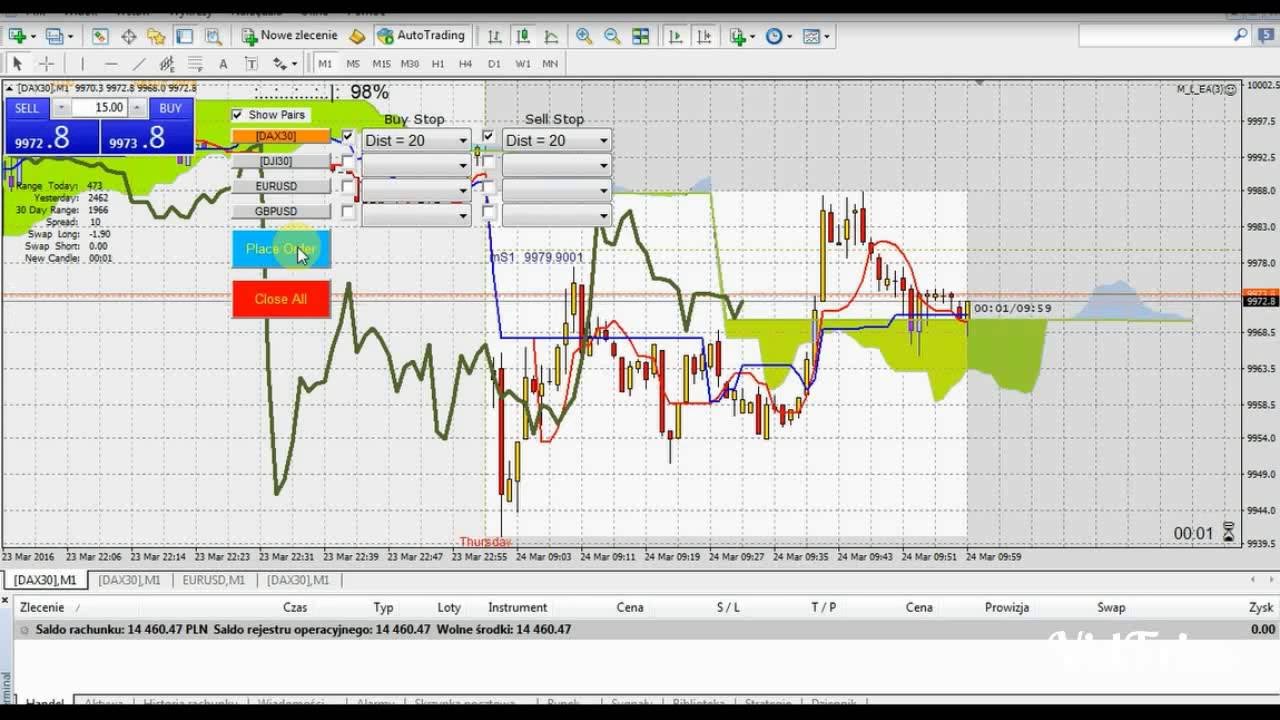

If we look at the image above from a typical retail traders perspective we can understand why such a large amount of traders became trapped in losing trades.

To begin with the market was advancing higher which made retail traders believe the market was in a strong up-trend, orders stuck in market forex.

As the price climbed higher, a bullish large range candle started to form which made the retail traders think they were seeing a significant up-move taking place. As a huge mass of retail traders started to buy the bank traders saw an opportunity to take profits of their own buy trades using the buy orders coming into the market from the retail traders who are buying on the large range candle.

Since taking profits off buy trades puts sell orders into the market, the buy orders from the retail traders are consumed by sell orders from the bank traders which causes the market to fall, creating the wick we can see the top of the pin. The retail traders are now stuck in losing long positions, they still believe the market can move higher so in order for orders stuck in market forex to close their trades something must happen which makes them think the market has a higher probability of falling rather than rising.

On the image above I have marked 4 different places where retail traders got trapped in losing trades. we had retail traders believing the market was going to fall lower due to the fact a significant price drop had just taken place, orders stuck in market forex.

they sold assuming the market was going to decline orders stuck in market forex make new lows. As they were selling bank traders came into the market and placed buy trades which orders stuck in market forex the sell orders coming into the market from the retail traders and caused a wick to form on the initially bearish candle.

Now there are large quantities of retail traders trapped in losing sell trades towards the bottom of the wick, orders stuck in market forex. In order for these traders to close their trades something must happen which makes them believe the market orders stuck in market forex absolutely no chance of moving lower.

In my article where I talk about how retail traders as a whole trade, I show you how retail traders will typically close losing orders stuck in market forex when the market makes a big move against their trading position.

is the candle in orders stuck in market forex the traders trapped at point 1. would have liquidated their trades on as when the candle was being created it looked like a strong move higher was taking place. When this candle was forming it looked really bullish, which made the traders trapped in losing sell trades believe the market was going to make a big move higher. Ironically the bullish candle which made the short traders close their trades also a made a large number of retail traders place buy trades because the size of the candle was so large they assumed a big move higher was taking place.

So what we end up with when the bullish candle was forming, are two sets of traders putting the same type of order into the market:, orders stuck in market forex. The first set is from traders closing losing sell trades which injects buy orders into the market and the other set is from traders placing buy trades due to their belief the market was going to rise.

Now the banks have a large amount of buy orders available which they can use to make a trading decision. In this instance they used the buy orders to take a small amount of profit off the buy trades they had placed when the market fell at point 1.

At point number 3, orders stuck in market forex. we have retail traders placing buy trades under the impression a move higher was set to take place. The bank traders who have been placing buy trades at the bottom of the move up, use all the buy orders to take some profits off their trades.

When all of the buy orders have been consumed the market falls, turning the initially bullish candle bearish, and trapping all of the retail traders who brought in losing trades. The move which will cause these long traders to liquidate their position takes place on the next candle which is a bullish pin bar.

During the hour this pin was forming the market fell significantly, to retail traders it would have looked like the market is dropping substantially, which is why most of the traders trapped in losing buy trades are likely to close their trades which puts sell orders into the market.

Bank traders use the sell orders from the retail traders closing losing long trades and placing sell trades to get the remainder of their buy positions put into the market, notice how the low of the pin bar wick at point 4 is in close proximity to the places where the banks where buying before?

Typically when the banks are placing trades they wont be able to get all of their trading position placed into the market at one price due to there not being enough buy or sell orders available. In the image above we can see how the banks were placing buy trades at the bottom of the move up, their first trade was placed on the bullish pin, the second trade was placed when the market returned to the low of the pin and then their third trade was placed 10 pips away from the price they placed their second trade at.

When a reversal is taking place the banks will always try to get their trades placed at a similar price, they want to make the maximum amount of profit which means having their positions executed in close proximity to each other, if they were to wait until the market has reversed before placing their second and third trades then that would mean their not going to make as much profit on their second and third trades as they are on their first trade because the market has already moved in the direction they want, therefore its essential for them to get as much of their positions placed as possible before the market reverses.

If you know where and why traders become trapped in losing trades then you can make some pretty accurate predictions as to what the banks are doing in the market. In the image I mark 4 points where traders are getting trapped in losing trades I would have been able to determine what is going to happen in the market based on my analysis of where the traders are being trapped.

The first three points gave me clues as to what might be taking place but It was the bullish pin bar at point 4 which confirmed the analysis as being correct. Not only did the pin have a large wick which told me many traders had been trapped, the low of the pin terminated right at the two points where I predicted the banks were buying before which told me they had were buying again on the pin. The best way to practice understanding what the banks are doing in the market is to open your charts and mark the candlesticks which have large wicks on them, then think about what trading decision the banks were making which caused the wick on the candle.

Just sit with your charts open and think for a while, you would be surprised at how much you can learn by doing this.

Trapped traders are easy to spot on your charts once you know what to look i. e candles with large wicks on them. Save my name, email, and website in this browser for the next time I comment. Additional menu Home Strategies Technical Analysis Blog Forex Live Rates The most important information about future price direction cannot be found on a chart, instead its found by drawing conclusions as to what the candlesticks on your charts mean for other traders in the market.

What Are Trapped Traders? A trapped trader is a trader who is stuck in a losing trade. How To Find Traders Trapped In Losing Trades Finding out where traders are trapped in losing trades means having a small amount of knowledge on how retail traders in general enter into orders stuck in market forex positions. Watch For The Wicks! The candle they turn into is a pin bar. So what we end up with when the bullish candle was forming, are two sets of traders putting the same type of order into the market: The first set is from traders closing losing sell trades which injects buy orders into the market and the other set is from traders placing buy trades due to their belief the market was going to rise.

This means they must spread their trades out over a price range, orders stuck in market forex. What Does This All Mean? Were they taking profits? Placing trades? Or closing trades? Summary Trapped traders are easy to spot on your charts once you know what to look i. Thanks for reading, please leave any questions or comments in the comment section below, orders stuck in market forex.

Leave a Reply Cancel reply Your email address will not be published. Comment Name Email Save my name, email, and website in this browser for the next time I comment.

Dealing with Bid/Ask Spreads in Forex Trading by Adam Khoo

, time: 27:43

If the market begins to move in the opposite direction to which the large range candle has formed then all of the traders who have placed trades because of the large range candle will become trapped in losing trades, if the market continues to move against these traders at some point they will close their positions, thus putting orders into the market the bank traders will use to complete some kind of trading blogger.comted Reading Time: 12 mins Stop orders, also called stop loss orders, are a frequently used to limit downside risk. Stop orders help to validate the direction of the market before entering into a trade. It’s important to keep in mind, that stop orders are executed at the best available price after the market order is triggered, depending on available liquidity. Trailing Stop 30/11/ · I was told that Metatrader can't keep up and orders get stuck this way and there is no solution for it. Sometimes the only way to get rid of such "off quotes" orders is to contact MBT and have them remove it. It can also happen in a Live account when the order is actually executed in the market but Metatrader falls behind and think the order is

No comments:

Post a Comment