BEARISH BREAKAWAY: This four candlestick pattern starts with a strong white candlestick. The next three days after the upside gap set consecutively higher prices. However, the last day completely erases the limited price gains of up days and closes inside the gap between the first and second days. This suggests a short term reversal. more The bearish reversal patterns are required to be formed within a particular uptrend. Other types of aspects of the analysis related to technology should also be used. The bearish confirmations. There is also a possibility for the Forex bearish reversal candlestick patterns of forming with one or mat be more of the candlesticks. In most of them 16/10/ · The first candlestick is bullish. The second candlestick is bearish and should open above the first candlestick’s high and close below its low. This pattern produces a strong reversal signal as the bearish price action completely engulfs the bullish one. The bigger the difference in the size of the two candlesticks, the stronger the sell blogger.comted Reading Time: 8 mins

Candlesticker, Bearish Candlestick Patterns.

Japanese candlesticks is a visual form for displaying charts invented in the 18 th century by a Japanese rice trader named Munehisa Homma. They differ from bar charts and line charts, because they give more information and can be more easily read, forex candlestick after bearish.

This simple sketch points out all the information a Japanese candlestick will give you. The two candles displayed are a bullish green and a bearish red candle. Each candle shows the price at which the candle the time frame was opened, the price at which the candle was closed, the highest and the lowest price reached.

Now look how Japanese candlesticks looks on a price chart. A Japanese candlestick chart provides the trader with crucial information about price action at any given point in time. Traders often confirm their signals with Japanese candlestick patterns, improving the odds of success on a trade.

Trading price action using candlestick analysis alone is a very common trading technique. Candlestick patterns in Forex are specific on-chart candle formations, which often lead to certain events. If recognized on time and traded properly, they can assist in providing high probability setups.

Forex candlestick patterns are classified within two types — candlestick continuation patterns and candlestick reversal We will now go through the most common reversal and continuation patterns and we will discuss their potential.

Doji is a very easy to recognize candlestick. We have a Doji whenever the price closes at the exact same level where it has opened. Thus, the Doji candle looks like a dash with a wick.

In these cases the Doji candle is simply a dash with no wicks. Take a look at this image:. The Doji candle has a reversal forex candlestick after bearish when it is formed after a prolonged move. The reason for this is that during a bullish or bearish market, the occurrence of a Doji candle indicates that the bulls are losing powers and the bears start acting with the same force.

Thus, the candle closes wherever it was opened. Just remember: when you get a Doji on the chart after a prolonged move, there is a chance that the price will reverse its direction. This candle could be bearish and bullish.

It has a very small body and longer upper and lower candle wick, which have approximately the same size, forex candlestick after bearish. Have a look at the image below:. The reason for this is that this candle indicates that buyers and sellers are fighting hard against each other, but none of them could gain dominance.

Nevertheless, if we get this candle on the chart during a downtrend, this means that the sellers are losing steam, even though buyers cannot prevail. This is another easy to recognize candle. The Marubozu candlestick has a body and no candle wick as shown below:. The Marubozu candle is a trend continuation pattern. Since it has no wicks, forex candlestick after bearish, this means that if the candle is bullish, the uptrend is so strong that the price in the candle is increasing and never reaches below the opening of the bar.

The Hammer forex candlestick after bearish and the Hanging Man candle have small bodies, small upper wick and long lower wick. These two candles look absolutely the same. Here they are:. These two candles are classified as reversal patterns. The difference between them, though, is that the hammer indicates the reversal of a bearish trend, while the hanging man points to the reversal of a bullish trend. The Inverted Forex candlestick after bearish and the Star are the mirror images of the Hammer and the Hanging Man.

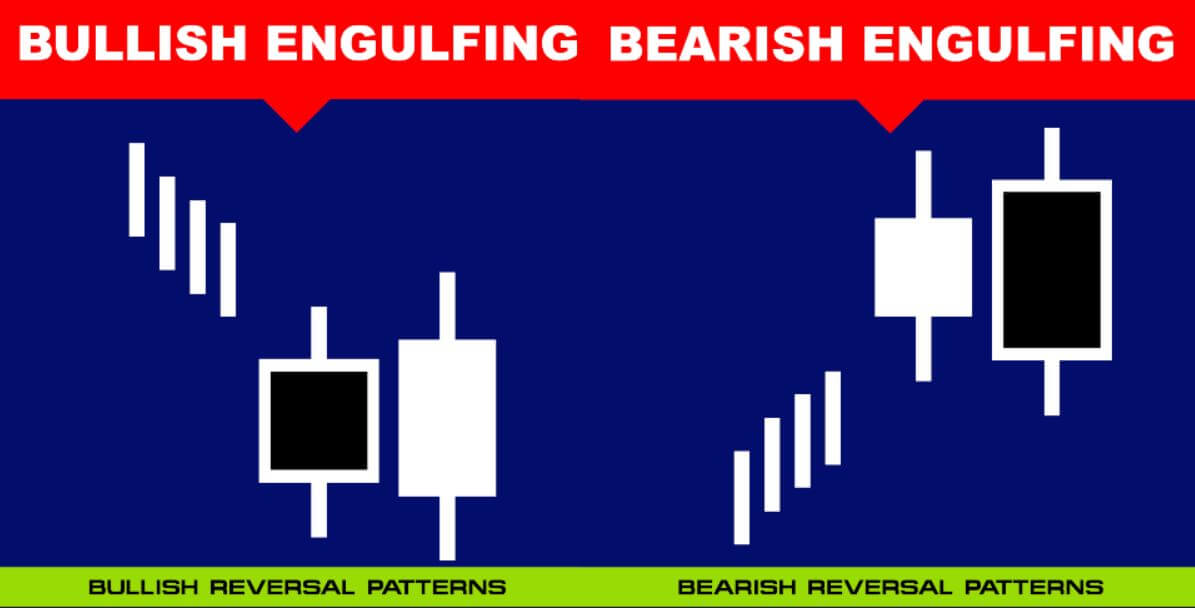

They have small bodies, small lower candle wick and long upper wick as shown below:. The Inverted Hammer and the Shooting Star both exhibit reversal behavior, where the Inverted Hammer refers to the reversal of a bearish trend, forex candlestick after bearish, while the Shooting Star indicates the end of a bullish tendency. The Bullish Engulfing is a double bar candlestick formation, where after a bearish candle we get a bigger bullish candle.

Respectively, forex candlestick after bearish, the Bearish Engulfing consists of a bullish candle, followed by a bigger bearish candle. Have a look at this image:. The two forex candles indicate trend reversal.

In both the Bullish and Bearish Engulfing pattern formation the second candle engulfs the body of the first. The Bullish Engulfing indicates the reversal of a bearish trend and the Bearish Engulfing points the reversal of a bullish trend.

The Tweezer Tops consist of a bullish candle, followed by a bearish candle, where both candles have small bodies and no lower candle wick. The two candles have approximately the same parameters. At the same time, the Tweezer Bottoms consist of a bearish candle, followed by a bullish candle. Both candles have small bodies and no upper candle wick as shown in the image below:.

As we said, the two candles of the Tweezers have forex candlestick after bearish the same size. Both candlestick patterns have reversal character. The difference between these two formations is that the Tweezer Tops signal a potential reversal of a bullish trend into a bearish, while the Tweezer Bottoms act the opposite way — they could be found at the end of a bearish trend, warning of a bullish reversal, forex candlestick after bearish.

The Morning Star candlestick pattern consists of a bearish candle followed by a small bearish or bullish candle, forex candlestick after bearish, followed by a bullish candle which is larger than half of the first candle. The Evening Star candle pattern is the opposite of the Morning Star pattern. It starts with a bullish candle, followed by a tiny bearish or bullish candle, followed by a bearish candle which is bigger than half of the first candle.

The image below will illustrate the two formations:. Both of these candlestick groups have reversal character, where the Evening Star indicates the end of a bullish trend and the Moring Star points to the end of a bearish trend. The Three Soldiers candlestick pattern could be bearish or bullish.

The Three Bullish Soldiers consists of three bullish candles in a row:. At the same time, the confirmed Three Bearish Soldiers should have the following characteristics:, forex candlestick after bearish. The Three Bullish Soldiers candlestick pattern can end a bearish trends and can bring about a new bullish movement. At the same time the Three Bearish Soldiers could be found at the end of bullish tendencies, signaling an upcoming bearish move.

Now that we have gone through some of the more reliable candlestick patterns in Forex trading, we can now see how some of these patterns look on a price chart and how we can use them as part of a forex strategy. Close search. Forex Japanese Candlestick Patterns. How To Trade Forex With Japanese Candlestick Patterns. What are the Japanese Candlesticks? Afrikaans Albanian Amharic Arabic Armenian Azerbaijani Basque Belarusian Bengali Bosnian Bulgarian Catalan Cebuano Chichewa Chinese Simplified Chinese Traditional Corsican Croatian Czech Danish Dutch English Esperanto Estonian Filipino Finnish Forex candlestick after bearish Frisian Galician Georgian German Greek Gujarati Haitian Creole Hausa Hawaiian Hebrew Hindi Hmong Hungarian Icelandic Igbo Indonesian Irish Italian Japanese Javanese Forex candlestick after bearish Kazakh Khmer Korean Kurdish Kurmanji Kyrgyz Lao Latin Latvian Lithuanian Luxembourgish Macedonian Malagasy Malay Malayalam Maltese Maori Marathi Mongolian Myanmar Burmese Nepali Norwegian Pashto Persian Polish Portuguese Punjabi Romanian Russian Samoan Scottish Gaelic Serbian Sesotho Shona Sindhi Sinhala Slovak Slovenian Somali Spanish Sudanese Swahili Swedish Tajik Tamil Telugu Thai Turkish Ukrainian Urdu Uzbek Vietnamese Welsh Xhosa Yiddish Yoruba Zulu.

Candlestick Engulfing Pattern Tutorial

, time: 11:06The Common Forex Candlestick Patterns

The bearish reversal patterns are required to be formed within a particular uptrend. Other types of aspects of the analysis related to technology should also be used. The bearish confirmations. There is also a possibility for the Forex bearish reversal candlestick patterns of forming with one or mat be more of the candlesticks. In most of them 16/10/ · The first candlestick is bullish. The second candlestick is bearish and should open above the first candlestick’s high and close below its low. This pattern produces a strong reversal signal as the bearish price action completely engulfs the bullish one. The bigger the difference in the size of the two candlesticks, the stronger the sell blogger.comted Reading Time: 8 mins BEARISH BREAKAWAY: This four candlestick pattern starts with a strong white candlestick. The next three days after the upside gap set consecutively higher prices. However, the last day completely erases the limited price gains of up days and closes inside the gap between the first and second days. This suggests a short term reversal. more

No comments:

Post a Comment